From the beginning to the end of a student’s formal education, there is constant evaluation. Each year, quizzes, tests, and papers are graded throughout the semester and these scores are ultimately compiled into a report card. These report cards are then used to help the student, the student’s parents/guardians, and the school faculty evaluate the student’s progress. For many, this is the stuff of nightmares. But if we let go of the emotional baggage and focus solely on the numbers, we can see how this is a useful approach to understand performance over time.

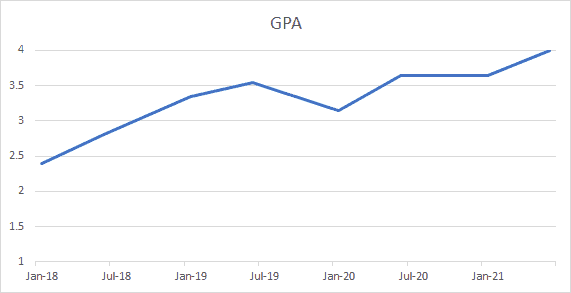

Let’s think about it graphically. On the y-axis, we would place grades, which could be broken up by subject, or aggregated to form a grade point average (GPA). On the x-axis, we would track time. So our graph would look something like this:

Almost anyone can look at this graph and immediately understand the data. This was a student who started out just below a C+ average and improved to an A average for the final semester. You can see that there were bumps along the way, i.e., the trend wasn’t purely linear. But the graph – and therefore the data – tell a story, a story of pretty considerable and consistent improvement over time

You may have had a wonderful academic experience, or you might have struggled through school. In either case however, whether you were a stellar student or a mediocre one, your grades told you – and your teachers – exactly where you stood. If you’re like me, those sorts of granular performance metrics all but disappeared once you finished your academic career.

The Gap Between Buyer and User

Ask most strategic sourcing professionals about where they invest their time and you’ll hear a familiar answer: “Identifying possible strategic suppliers and including them in strategic sourcing events like RFPs.” Here’s the question that’s not getting asked enough: “What is the state of your current supply base?” Or put more colloquially, “What’s the story with your vendors?”

It’s not surprising to find out that many will tell you that they simply don’t know. They source the vendors and then pass them off to the stakeholders who are the ultimate users of the product or service. If you are tasked with the responsibility of finding a CRM for your organization’s sales team, you can run a really tight process, gather all the requirements, leverage stakeholder expertise, and select what everyone is convinced is the best CRM provider for your needs. Once that process is complete, you have to move on to sourcing the next product or service. The vendor relationship is handed off to a colleague who manages sales operations, and as is often the case, the status moves from out of sight to out of mind.

So when that contract comes up for renewal, what do you do? You plan to renew of course. But in the days leading up to the renewal, you just happen to find out that the sales team is miserable with the CRM. By now, however, it’s too late; you have no choice but to lock yourself in to another year with the provider.

The above example underscores a significant problem – the growing disconnect between the people who are tasked with purchasing products and services and the people who ultimately use them. In some respects, it makes all the sense in the world. Your sales team should be focused on selling; your marketing team on marketing; your HR team on…HRing; and your strategic sourcing team on sourcing. Maintaining open lines of communication around hundreds, thousands, or tens of thousands of suppliers is not simply onerous, it’s impossible. But while this might make logical sense, accepting a data black hole as inevitable is folly. Fortunately, there exists a deus ex machina – the supplier performance scorecard.

What are Supplier Scorecards?

Imagine you could have, with the touch of a button (or click of a mouse), real insights into the performance of your vendor pool. Now close your eyes, metaphorically at least because it’s going to be really hard to read with your eyes closed, and envision a world where these performance metrics were gathered by some combination of hard data, e.g. defect rates, on-time delivery frequency, etc., and by more qualitative analysis by the stakeholders who are most engaged. By implementing a scorecarding program, your wildest dreams can turn into reality.

The key to a strong scorecarding program is effective data collection. As mentioned above, quantitative data may well be pulled from other systems like ERPs or accounting software. The qualitative data, which is often where the rubber meets the road, is gathered via surveys. How to build a survey is beyond the scope of this introductory article, but the premise is simple: you create a list of questions that can be used to assess the vendor’s performance. These questions are typically grouped into sections – think “Customer Service,” “Product Quality,” etc. – and distributed to stakeholders who are regularly engaged with the vendors that are being evaluated.

Completed surveys are collected and the data is aggregated, ultimately generated a score. This score is, for all intents and purposes, the GPA of the vendor. And you, the buyer, can watch how different vendors’ GPAs change over time.

The Benefits of a Scorecarding Program

Here’s the unfortunate truth about working in strategic sourcing – you will almost always find yourself at an information disadvantage. You’re an IT category manager and have an expertise in IT? Great. But the person who is selling you Managed DNS only has to master that one subject. Good salespeople will always know more about the product they’re selling than the buyer does. But when you have supplier performance scorecards, you are empowered by data. You can proactively put suppliers into corrective action plans. (The academic equivalent is an ad hoc parent-teacher conference!) You might decide to put a contract for a product or service back out to bid. And when the data looks really good, you might negotiate a multi-year or larger scale agreement to leverage volume discounting while investing in the relationship.

Another significant benefit is giving stakeholders the ability to be heard without overwhelming the recipients of the feedback. Structuring the surveys in a smart way enables stakeholders to share their opinions while providing vendor managers and strategic sourcing team members actionable insights.

Wrapping Up

We live in a world where organizations are increasingly dependent on a litany of providers who are employed somewhere else. Renowned entrepreneur, Auren Hoffman, writes, “99% of companies and organizations have more vendors than employees…. Stitching together the right vendors is really, really hard. Researching vendors and getting them to work together is really hard. Figuring out the right ones is hard. Getting the most out of them is hard. Getting a great return on your investment is hard.”

Want to make things easier on yourself and better for your organization? Set up a supplier performance scorecard and put the data to work.

(And if you're interested in taking a deeper dive, we invite you to check out Vendorful's Essential Guide to Vendor / Supplier Scorecards.)