The Essential Guide to Vendor / Supplier Scorecards

Introduction

Imagine spending hundreds or thousands or even millions of dollars on a product or service, and not knowing whether it adds value to your organization. Today, there is a cost to every aspect of information not captured. In most organizations, irrespective of size, there is a disconnect or an information gap between purchasing a product and feedback on how effective or useful the purchase is. For example, imagine that the sales department needs new lead tracking software. They dot all their “i’s” and cross all their “t’s,” running a very tight process in conjunction with procurement to develop a set of requirements, identify potential suppliers and go through a stringent selection process (including an RFP) to identify and acquire the right software. When it comes to the sourcing process, they do everything “by the book.” However, this collaboration between stakeholders and procurement is typically limited to the initiation of the engagement with the supplier. In this case, once the software license has been acquired and distributed, the procurement team moves on to the next thing on their agenda and the sales team begins to use the new software. The real issue arises a year later, when the software license is up for renewal. What happens then? Is the sales team happy with its experience or not? Have the sales people identified pain points that they would like to address with a different version of the software or with new software altogether? If they are unhappy, how much lead time does the procurement team have to find a replacement? Could this problem have been identified earlier? There is certainly lots of information available about the performance of this software vendor and the views of the sales team about the ROI, support level, etc. However, all of this information is usually hidden in the minds of the stakeholders, the sales team members in this example. To turn this into actionable data, you can bring in a mind reader...or set up a scorecarding program.

Indeed, a thorough scorecarding process allows for this information to be readily available to the procurement team. Armed with this information, team members can, in turn, mobilize sooner with specific actions. An underperforming supplier? Welcome to the corrective action program. An amazing supplier? Let’s look at locking in a long-term contract before prices go up. Even leaving the status quo in place can — and should — be a deliberate, data-driven decision. The trick is to get the necessary information out of the ultimate “silo”: the human brain.

Organizations that live and breathe and true strategic sourcing culture are focused on optimizing value, not price. Price is an ingredient in the value stew, not the stew itself. And this can even hold true for commodity items, particularly if they play a strategic role in the delivery of an organization’s products and/or services. Imagine a world where you are engaged with multiple suppliers for the same product. For simplicity’s sake, let’s say that the product is a zipper. All of the suppliers deliver zippers to the same specifications, i.e., the materials, weight, and dimensions are consistent. One of them is appreciably less expensive though. In an information vacuum, one would be inclined to increase spend on the low-cost provider and reduce spend with the more-expensive vendors. A cursory financial analysis would suggest that this is a great approach to increase margins. But what if you knew that the defect rate was 500% higher with the low-cost option? Depending on the value calculation — which should include the short- and long-term costs of a high defect rate — it may not make sense to continue using them at all, regardless of the price advantage. Taking this a step further, let’s imagine that the engagement with this supplier was terminated. Now there is more money to spend on the remaining suppliers, which can be leveraged for volume discounting. If you are able to get higher quality at lower price, that certainly represents increased value. In this example, the company would see margin expansion and quality improvements rather than having to trade one for the other.

A well-managed scorecarding program can help organizations optimize costs (by providing a basis for negotiation and allocation), better supplier relationship management and improve supplier performance.

Scorecarding can seem complicated to implement, but we’re here to disabuse you of that notion. More importantly, it is an essential cog in the procurement process that firms of all sizes and expertise stand to gain from. It is, however, important to be mindful of certain considerations in the implementation. So we took it upon ourselves to create a digestible guide that you can use to launch your own scorecarding program.

Download this page as a PDF for offline reading!

Part 1

What are Scorecards?

If you find yourself frantically running a Google search to figure out what a scorecard is — stop and read on!

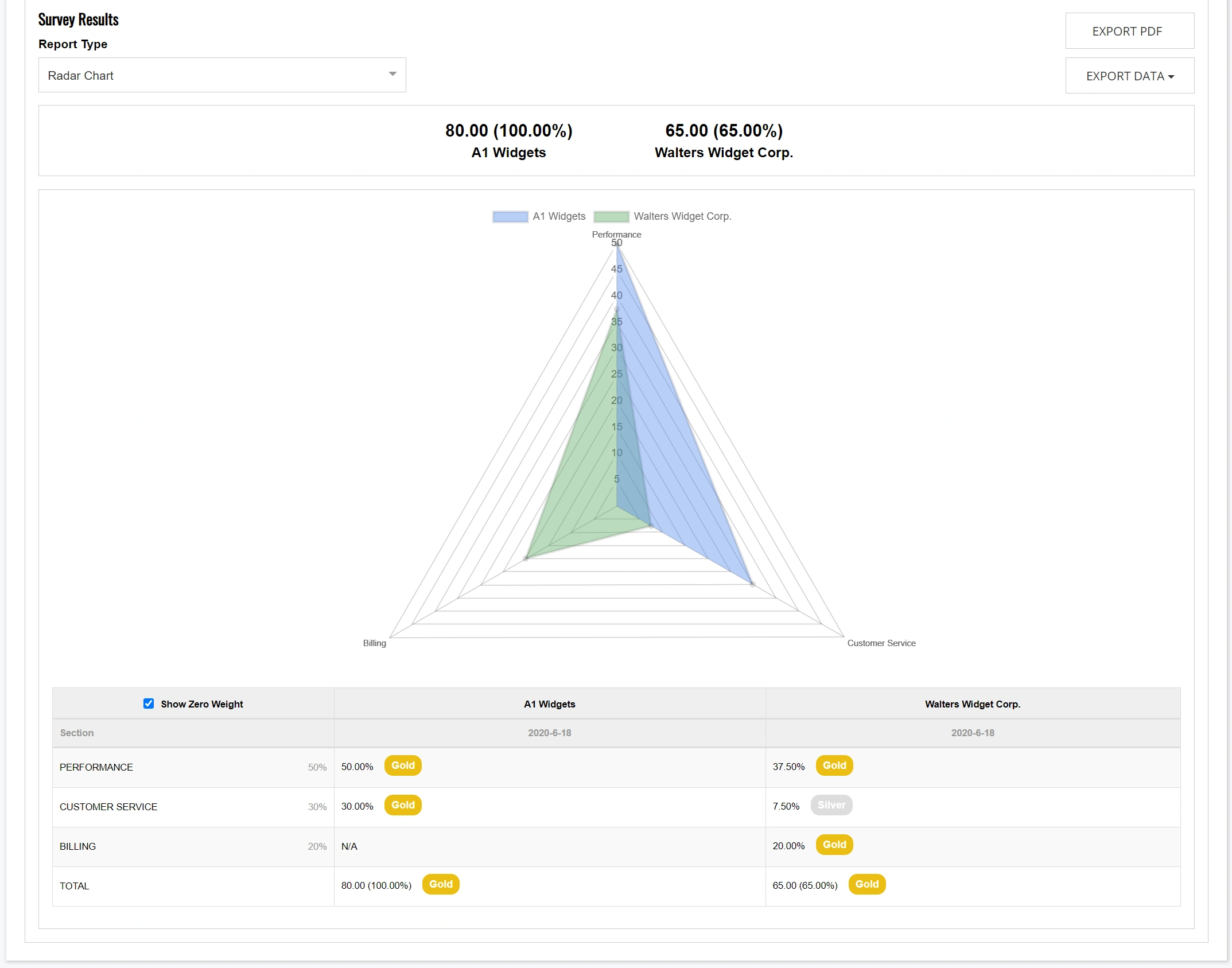

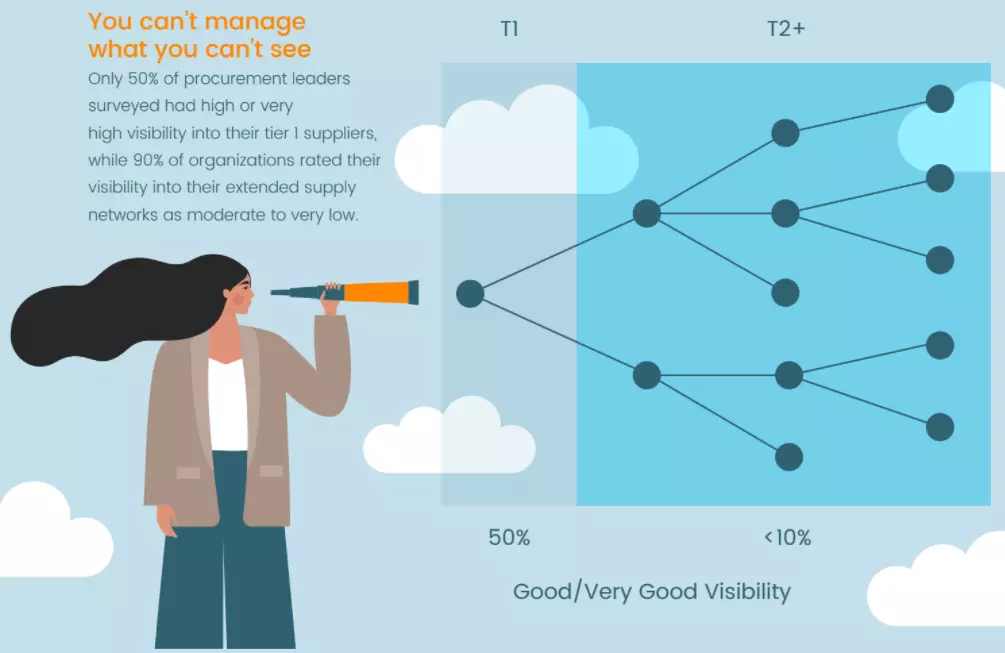

A supplier scorecard (or vendor scorecard, the terms can be used interchangeably) is a mechanism to monitor and index performance in a transparent and easy-to-understand format. A well-defined scorecarding process helps procurement teams as they evolve from transactional to more holistic in their approach. Scorecards empower them to make data-driven decisions and capture insights around supplier performance. In addition, it’s not only helpful for capturing feedback, but also can be leveraged to help suppliers improve. Scorecard data, when shared with vendors by procurement teams and stakeholders can support improved relationships with vendors by facilitating a regular stream of communication. Indeed, the benefits of a supplier scorecarding program are numerous and address many of the problems plaguing procurement today, e.g., poor visibility into suppliers, disgruntled stakeholders who feel like they’ve been saddled with underperforming vendors, poorly optimized supply base, etc. Despite this, most procurement leaders surveyed today, reported a shockingly low level of visibility into their supplier networkImage adapted from: Deloitte, Chief Procurement Officer Flash Survey 2020

With organizations regularly having more vendors than they do employees, this is a shocking statistic. Can you imagine if firms lacked insight into the productivity of 50% of its key employees and 90% of all the other employees? That would be a five-alarm fire in the human resources department. But despite the outsized importance of the supply base to an organization’s success, this is essentially what’s happening on the vendor side of the house. As beneficial as the process is, teams often struggle with defining and implementing scorecarding. As you can imagine, it’s critically important for a business to identify the right metrics and capture the required data to build their scorecards. Getting everyone on the same page can be a challenge. However, once there is internal alignment, there is another hurdle; a big hindrance to an effective program is the manual nature of most scorecarding efforts, which results in low engagement and therefore unreliable data while consuming significant time.

Hindrance or not, if you don’t have a scorecarding program in place, the best time to start an ongoing evaluation process for strategic suppliers is now. If anything, the COVID crisis has underscored the criticality of having a diversified and reliable supply base. A key technique to ensure that is the case? Scorecarding. In the sections below, we will focus on the main challenges that businesses face in establishing a program, the benefits of this program, as well as some nuanced tips on how to strategically leverage and implement the underlying processes. Please note that, we use the terms “vendor” and “supplier” interchangeably to refer to an external provider of a product or service. On the flip side, we also use the terms “buyer,” “procurement teams,” and “purchaser” to refer to an entity that has sourced, or is planning to source, a product or service.Part 2

What Do I Need for Scorecarding?

You now know that if you don’t have a scorecarding process, you should implement one at the earliest. But where do you start? Much of the data that you collect will be captured through surveys that you send to stakeholders who work with specific vendors. But how does one go about figuring out what should be asked on the survey? We have outlined some important next steps to get you started.

The success of a scorecarding initiative depends on the following key decisions:

- Key Performance Indicators (KPIs)

The first step is to identify the right performance indicators to assess whether or not vendor performance is aligned with business objectives. It’s easy to mess this up; the most common mistake involves including too many KPIs. A good rule of thumb is to start with roughly five KPIs — to be increased or decreased based on business need. While there are several ways to measure performance, the basics include: quality, vendor responsiveness/communication, on-time procurement and price variance. To this mix, add customized metrics more uniquely aligned with business objectives.

In the beginning of supplier scorecard implementation, plan to review your KPIs frequently. Don’t be afraid to pare down metrics that don’t seem useful over time. As we’ll discuss later, “short and sweet” is a great approach.

- Define sources, and data standards

For each KPI, identify sources of data from all the relevant applications. Data collection and evaluation can be time intensive, but is essential to effective scorecarding implementation. Bear in mind that the data sources are often people (remember, we’re getting a lot of information out of people’s heads), which is another reason to make sure that you’re not juggling too many KPIs. If your surveys get too large, you’ll see a drop off in response rate.

After identifying KPIs and their associated data inputs, the next step is to assess data standards. When tapping into the opinions of stakeholders, you’ll be well served by providing a limited range. The most common one is one to five, where five is the best score and one is the worst. (Report-card style evaluations — A, B, C, D, F — are also quite popular.)

- Mix quantitative and qualitative data

A balanced scorecard includes both qualitative and quantitative data inputs. While in most cases, qualitative or anecdotal data is easy to gather, it can be challenging to evaluate both historically as well as for comparison purposes. This is another area where having a defined range comes into play as it allows you to transform qualitative perspectives into hard numbers. Other times, you’ll be able to get natively numeric data, e.g. defect rate, shipping performance, etc. Numeric data, whether presented as a range or just as a raw number is also helpful in that it can be summed, averaged, and ultimately compared across vendors. That doesn’t mean that there shouldn’t be a place for comments, but the foundation of your analysis should be rooted in numbers.

- Supplier Surveys and Audits

Surveys — and in some cases, audits — can be foundational components on top of which scorecards are built. Surveys are used to gather information about the suppliers from the stakeholders who engage with them. Audits can be structured similarly, but are usually reserved specifically for suppliers of raw materials and often include site visits and assessments of the suppliers internal systems and processes. They can often provide good intel on quality assurance procedures and standards that suppliers are using. Surveys and audits sometimes culminate in a Final Report, which includes strengths, weaknesses, critical observations and improvement opportunities.

Scorecards should contain information collected from surveys (as well as audits and inspections when appropriate) to ensure vendors are also evaluated on the processes and systems they use internally, which in turn impact the goods or services procured.

- Assign weights to KPIs

Some KPIs will be more important or business critical than others. Weighting isn’t essential but can be helpful in order to rank suppliers and ensure that your comparisons are focused on the most important factors. Assign weights based on importance and with the aforementioned conversion of qualitative inputs to a numerical scale, you will be able to build an easy-to-analyze view of suppliers based on the criteria that you value.

- Index and analyze rankings

An index of suppliers makes it easy to prioritize supplier relationships as well as identify best practices. Successful scorecarding is contingent on frequent and effective communication with vendors. This system helps to identify improvement opportunities and best practices to share as feedback with suppliers.

Part 3

Areas of Optimization

When you are developing a scorecarding program, bear in mind that you want to optimize for a few key outcomes: engagement, data compilation, and comparability. Any decisions you make that undermine these outcomes are likely to compromise your process. We’ll get into some specific challenges in a bit, but let’s first take a look at what these outcomes are and why they’re important.

Stakeholder Engagement

For good or for ill, the success of your scorecarding program hinges on the responsiveness of stakeholders. For that reason, it’s critically important that you design a survey that is clear and concise. You want to reduce the cognitive load on the person who is filling out the survey. Surveys that take no more than a couple of minutes to complete are most likely to be filled out and returned. Similarly, by adhering to a standard template — or a small set of templates — you can ratchet up engagement.

Data Compilation

In a perfect world, each vendor would be evaluated with a uniquely bespoke survey. However, in the real world, that creates a variety of problems. One that we’ve discussed is stakeholder engagement, which declines as survey specificity increases. Another that we’ll cover in a moment is comparability. But even the process of compiling this data can be made far more onerous than it needs be when there is significant variability between surveys. By keeping, for example, the range options consistent across surveys, you simplify the process of turning raw data into a score.

Comparability

Part of the value of a scorecarding program is comparing a supplier to expectations or contractual representations. However, if that’s the extent of what you’re doing, you’re only reaping a limited subset of the benefits. Indeed, you want to be able to compare suppliers against their peers. To do this effectively — and easily — you want to make sure that the data is normalized. If Supplier 1 is being evaluated on a one-to-ten scale and Supplier 2 is being evaluated with a “report card” model (A, B, C, D, F), a head-to-head comparison is not immediately obvious.

When building your surveys, take time to “measure twice and cut once.” You don’t want to start a major scorecarding undertaking only to find out that stakeholders are disengaged and that the data you are collecting is difficult to aggregate and compare. Now that we’ve established some key goals in survey construction, let’s make sure we’re clear on what should be avoided.

Part 4

Stumbling Blocks

Can any good scorecarding implementation be complete without deeply understanding common pitfalls? No! That is why we have identified a few potential roadblocks to implementing and running a scorecarding initiative. As beneficial as the end goal might be, without a few checks and balances in place, the results might be underwhelm.

Here’s a few challenges that businesses commonly encounter:

- Issues with metrics

Often businesses identify metrics best aligned with business goals, but end up incorporating less effective metrics in the scorecarding process due to ease of integration, timely availability and other factors. This undermines the effectiveness of the implementation even before it’s begun.

Tracking too many metrics can make the process more cumbersome and less effective. In addition, this can result in the desire to create many bespoke surveys, which creates its own set of headaches (poor engagement, compilation overhead, difficulty with apples-to-apples comparisons, etc.). Quality of metrics should trump quantity.

Incorporating metrics that are misaligned with business objectives is another common pitfall. Business needs or objectives could mean reviewing metrics that are different from those that an industry at large is leveraging. Misaligned metrics result in insights that aren’t actionable, and over time, reduce confidence in the scorecarding exercise.

Metrics that require data cleansing or manipulation prior to scorecarding are also more likely to fail. This increases the amount of time required to update scorecards and derived or manipulated metrics are often harder for vendors to translate into actionables at their end.

- Data Integrity and manipulation

Tracking data inputs is dramatically simplified by storing and accessing the relevant data on the same platform. Disconnected tools like email chains and Excel sheets often complicate the process of aggregating and ultimately displaying the data. For smaller supply bases, you might be able to make do with an email and spreadsheet approach. At scale, however, integrated tooling becomes the only practical way to run a scorecarding program short of increasing headcount.

A lack of internal support and discipline can also further complicate matters. A software solution should do more than aggregate and display the data; it should also track survey completion, send reminders, etc. to ensure that maximal data is captured.

- Ineffective communication

The success of scorecarding implementation is further enhanced by a regular feedback mechanism.

It’s important for suppliers to understand a buyer’s business objectives, and how their performance impacts these objectives to be able to leverage scorecarding efficiently.

Not sharing scorecard results and insights with suppliers reduces the value of this exercise. While internal vendor rationalization is typically the primary focus, scorecarding is less effective in a vacuum. On the flipside, regular communication could be the much-needed aid to performance improvement.

If there is no action or follow up to scorecarding results, suppliers will likely become confused by the purpose of scorecarding. It’s important to tie in recognition, rewards, and corrective guidance to further build on this exercise.

Part 5

Core Benefits

Even though scorecarding comes with its own set of challenges, its benefits far outweigh other considerations. “What gets measured gets managed” is an oft-repeated adage. Shifting this around though, you can ask yourself the question, “How do I manage something that I don’t measure?” Supplier scorecarding enables buyers to gain actionable insights into the best and worst suppliers. In addition to vendor performance management, scorecarding also helps in managing relationships, minimizing errors, optimizing costs and mobilizing continuous improvement.

In order to set you up for success, we have outlined core benefits of the exercise below:

- Effective Performance Management

Scorecarding can simplify the process of identifying suppliers that are leading or trailing respectively.

Scorecarding helps to identify poor performance and recommend corrective action. When supplier performance is slipping, SCARs i.e., Supplier Corrective Action Requests are issued as formal communication.

Similarly, the best suppliers are identified using scorecarding and buyers are able to effectively prioritize these supplier relationships. These suppliers are also likely to be rewarded with more business opportunities, strategic partnerships or certifications.

- Objectivity

Supplier scorecarding facilitates an objective, data-driven approach to supplier performance. It also reduces the risk of errors and personal biases in supply chain management.

Scorecarding provides suppliers with transparency in performance management and evaluation. Suppliers are able to accurately compare their performance to their past record — and in some circumstances — to other suppliers in the same space.

Scorecard data should be a key factor in the supplier selection process for new requisitions. Consistent and excellent supplier performance should be rewarded.

- Tracking and Benchmarking

Scorecarding also enables buyers to analyze supplier performance trends over time. This analysis can be a key indicator of potential issues and an important input for insights.

Scorecards can help index suppliers, to enhance procurement decision making and benchmark performance for comparison purposes.

- Specificity

In addition to being an analytical tool, scorecards also help an organization with self-evaluation. Customizing scorecarding enables procurement to manage, monitor alignment with and maintain business objectives.

- Negotiation Support

Pricing and price variation data gathered from scorecarding can also help support existing and upcoming negotiations with vendors.

- Decision Making Aid

Scorecarding helps visualize data and gather insights to enable corrective action and simplify decision making internally.

- Improve partnerships

Scorecards create transparency and facilitate a flow of regular communication between vendors and buyers. This, in turn, is essential to improving supplier relations.

Scorecards aren’t intended as standalone tools; procurement stands to extract maximum value only if scorecarding is fully integrated in standard operations and vendor management.Part 6

How to Successfully Leverage Scorecarding

Scorecards aren’t intended as standalone tools; procurement stands to extract maximum value only if scorecarding is fully integrated in standard operations and vendor management.

Even though scorecarding comes with its own set of challenges, its benefits far outweigh other considerations. “What gets measured gets managed” is an oft-repeated adage. Shifting this around though, you can ask yourself the question, “How do I manage something that I don’t measure?” Supplier scorecarding enables buyers to gain actionable insights into the best and worst suppliers. In addition to vendor performance management, scorecarding also helps in managing relationships, minimizing errors, optimizing costs and mobilizing continuous improvement.

In order to set you up for success, we have outlined core benefits of the exercise below:

- Effective Performance Management

Scorecarding can simplify the process of identifying suppliers that are leading or trailing respectively.

Scorecarding helps to identify poor performance and recommend corrective action. When supplier performance is slipping, SCARs i.e., Supplier Corrective Action Requests are issued as formal communication.

Similarly, the best suppliers are identified using scorecarding and buyers are able to effectively prioritize these supplier relationships. These suppliers are also likely to be rewarded with more business opportunities, strategic partnerships or certifications.

- Objectivity

Supplier scorecarding facilitates an objective, data-driven approach to supplier performance. It also reduces the risk of errors and personal biases in supply chain management.

Scorecarding provides suppliers with transparency in performance management and evaluation. Suppliers are able to accurately compare their performance to their past record — and in some circumstances — to other suppliers in the same space.

Scorecard data should be a key factor in the supplier selection process for new requisitions. Consistent and excellent supplier performance should be rewarded.

- Tracking and Benchmarking

Scorecarding also enables buyers to analyze supplier performance trends over time. This analysis can be a key indicator of potential issues and an important input for insights.

Scorecards can help index suppliers, to enhance procurement decision making and benchmark performance for comparison purposes.

- Specificity

In addition to being an analytical tool, scorecards also help an organization with self-evaluation. Customizing scorecarding enables procurement to manage, monitor alignment with and maintain business objectives.

- Negotiation Support

Pricing and price variation data gathered from scorecarding can also help support existing and upcoming negotiations with vendors.

- Decision Making Aid

Scorecarding helps visualize data and gather insights to enable corrective action and simplify decision making internally.

- Improve partnerships

Scorecards create transparency and facilitate a flow of regular communication between vendors and buyers. This, in turn, is essential to improving supplier relations.

Conclusion

Too often, when people hear the term “Strategic Sourcing,” the term that comes to mind is “RFP.” And RFPs are critically important as part of a broad Strategic Sourcing vision. But what about the vendors that you have now? And what of those suppliers who win the RFPs and are awarded contracts? Time doesn’t stop once the RFP concludes. This is why scorecarding is so important.

Organizations that are able to leverage performance data make better use of RFPs. They know when an underperforming vendor needs to be replaced, necessitating a sourcing event. But they also benefit from avoiding unnecessary RFPs by having the ability to work with their vendors to optimize performance and meet KPIs.

We encourage you to think of Strategic Sourcing as a culture supported by processes. And those processes should speak to the full lifecycle of the supplier engagement. So if you haven’t yet implemented a scorecarding program, load up Excel — or your spreadsheet program of choice — and get started. Or if you’ve started and haven’t been able to scale or repeat your efforts, reach out to software providers who can automate much of the process for you. In procurement, one of the best ways to improve your own performance is to improve the performance of your supply base. And a good scorecarding program will help you do that.

Learn More about Vendorful

Click the button to learn about the Supplier Scorecard component of Vendorful's SRM software so you can maximize supplier performance.

Put a Demo on the Calendar

We'll show you how you can use Vendorful to measure and update the performance of your vendors.