The Essential Guide to Reverse Auctions

Introduction

A reverse auction is a well-understood process for running a real-time, transparent, market-driven price negotiation with vendors. Historically, these have been complex events that required expensive enterprise software that were almost exclusively in the domain of the Fortune 1000. In recent years the emergence of “the cloud” has made it possible for mid-market businesses and SMBs to avail themselves of this process, not to mention not-for-profit organizations, higher education, and others. However, despite the affordability of the software and often incredible ROI, reverse auctions remain a mystery to many.

Indeed, most negotiations happens via email and/or phone. More sophisticated organizations may well begin the negotiation process via a multi-round RFP (Request for Proposal) or RFQ (Request for Quotation). Starting the negotiation by having multiple vendors—we’ll use the terms vendors and suppliers interchangeably—bid to provide goods and/or services is a great way to get started. As a buyer, you’re collecting intelligence from a swath of the market and the data that you gather not only sets a baseline for individual vendors, but a reference point across the pool of vendors. At this point, buyers will necessarily narrow down the list and choose one, two, or possibly three vendors with which to negotiate. From there, emails are swapped, phone calls are placed, and ultimately an agreed-upon price is reached with the winning vendor. It doesn’t sound too bad, does it?

The reality is that collapsing weeks or months of work into a few sentences is easy. The actual negotiating process? Not so much. Discussions can be extremely protracted — particularly when multiple vendors are involved — costing valuable time for buyer and seller alike. Enter the reverse auction.

In the right circumstances, a reverse auction procurement can reduce months of negotiations to minutes, while allowing the buyer to optimize for pure cost savings or aggregate value. Those circumstances are important though, as are the rules of engagement. In the pages that follow, we’ll walk you through the key information to help you identify reverse auction opportunities, set them up, and start seeing ROI.

This is a long document so we encourage you to use the table of contents to navigate through The Essential Guide to Reverse Auctions.

Download this page as a PDF for offline reading!

Auction Overview

If you’ve watched enough movies, you’ve doubtless seen an auction. For dramatic effect, writers and directors typically show an English Auction, also known as an “Open Outcry” Auction. To help turn abstract concepts into relatable principles, let’s walk through what we usually see and break down the action.

In the front of the room stands the auctioneer. She presents a piece of art, tells the audience the starting price, perhaps an increment, and then bangs a gavel to begin. A sign pops up near the back of the room and the auctioneer points at the man holding the sign. The man yes, “One-hundred thousand dollars.”

Not to be outdone, a woman in the third row thrusts her sign in the air. When the auctioneer points at her, the woman exclaims, “One-hundred-ten thousand dollars!”

The action continues, with the auctioneer periodically interjecting: “I see one-hundred-seventy thousand dollars. Do I see one eighty?” Signs are lifted eagerly and then less eagerly until it’s down to just a handful of bidders. The bidding passes two-hundred thousand dollars and the man in the back just can’t bring himself to counter. The auctioneer announced, “Two-hundred-ten thousand dollars…. Going once.”

The woman in the third row looks around the room, wearing a confident smile that suggests to anyone who is looking that she won’t be outbid.

“Going twice,” announces the auctioneer, who pauses for a moment before increasing the volume of her voice: “Three times!”

“Sold!”

And thus, the auction is complete. While we’ve identified the auction style as “English,” it’s also worth noting that the above describes the action in a forward auction. In this guide, we’re primarily going to concern ourselves with the opposite, reverse auctions. It’s easy to distinguish between the two.

In a forward auction, buyers compete to purchase something and push the price upward.

In a reverse auction, vendors compete to sell something and push the price downward.

Although procurement departments may, on occasion, benefit from running a forward auction (imagine a company that wanted to auction off excess inventory), they will primarily concern themselves with reverse auctions. That said, whether the prices are moving forward or in reverse, the principles are quite similar.

In the digital realm, many millions of people have participated in auctions via eBay or other e-commerce sites. While they are typically conducted online, reverse auctions run my procurement departments feel different. They tend to mirror in-person auctions much more closely and move at a faster pace. If you have experience with an e-commerce online auction site though, it certainly can’t hurt as your ramp up your reverse auction knowledge.

The key principles for auctions, whether they are forward or reverse, online or in person, are the same. Auctions have the following characteristics:

- Market-driven pricing

- Transparent rules and outcomes

- Defined completion criteria (usually time-based)

- Pre-commitment by all parties to transact at, subject to conditions laid out in the rules (such as reserve price)

The last point is a particularly interesting one. In an auction, both the buyer and seller agree to do a deal before they know the price. Though this is atypical for most transactions, each of the parties should be able to take comfort that the result will be fair as the market dictates the price point.

Running a Reverse Auction

Like a hammer, a reverse auction can be a valuable tool in your tool belt. And like a hammer, it’s not great at screwing in Phillips-head screws. Indeed, while there may well be a temptation to use reverse auctions to negotiate every deal with a supplier, it’s probably not a good idea. There are those who disagree with us. In a meeting, a sourcing manager from a Fortune 100 company, “You tell me the product or service and I can tell you how to run a reverse auction for it.” While it might be technically true, it’s also technically true that you whack screws into wood with a hammer.

Judicious procurement experts leverage reverse auctions for the appropriate categories at the appropriate time. Ascertaining which categories are appropriate and when is some mix of art and science, but there are a few guidelines that should help you make smart decisions.

- Don’t run reverse auctions when vendors have extremely differentiated offerings. For example, if you were to run a reverse auction for something broad, like cars, you might end up having a Ferrari compete with Prius. They might both be nice cars and share a category, but they are two very different things. Reverse auctions are best when there is a tightly-defined specification in more commoditized product and/or service categories.

- Be careful of using reverse auctions when optimizing for value rather than simply price. You can use reverse auctions as part of a value-based sourcing process, but you need to be extra mindful. The steps that precede the auction as well as the auction type itself must be carefully considered.

- Don’t ambush strategic suppliers with reverse auctions. While it is perfectly valid to have long-standing incumbent vendors participate in reverse auctions, you’ll want to make sure that you engage with them before simply sending an invitation to compete.

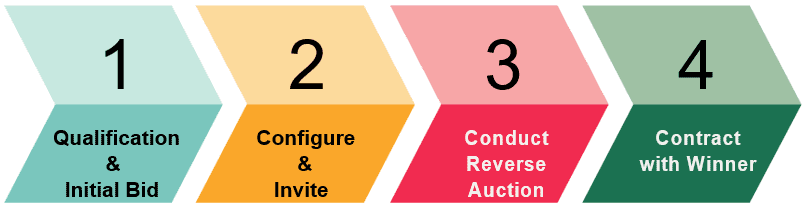

Once you’ve decided to run a reverse auction, there are a series of steps that you’ll take to set up and execute the auction.

Qualification and Initial Bid

Once you have a qualified list of vendors, you’re ready to begin configuring your reverse auction. The first step is to figure out what kind of reverse auction you want to have. There are multiple styles and we deliver more details on some of the most commonly-used ones below. While some providers offer an array of switches and toggles that allow a buyer to configure every element of the reverse auction, we strongly suggest that you abide by the well-established rules of the type of auction you are using. Here’s why….

Imagine you invited a handful of vendors to compete for your business, but rather than using a reverse auction, you used a ball sport. Now, if you told the vendors that the contract would be awarded to the company that sank the most free throws, scored the most goals, had the lowest score on a golf course, etc., the vendors would know exactly how to respond. The options cover several sports, but the rules for each of those sports are well understood and well documented. If you’re changing too many toggles for the sports, however, you could end up with something that is far less familiar for the participants.

“Welcome vendors. The company that successfully uses a golf club to hit a hockey puck into a basketball net the most times in the next twenty minutes wins the business.” This may work well on a wacky TV game show, but it’s going to undermine your outcomes in a reverse auction. For the most part, you should select an auction style and configure the following (where applicable):

- Start Time: The day and time that the auction begins.

- End Time: The day and time that the auction ends and/or when Overtime rules come into effect.

- Maximum Bid: This represents the “ceiling” for bids and indicates that you won’t accept anything higher than this number. Since you should have received initial bids, you should be able to set this if you choose. Not setting it usually isn’t a problem either as the bidders will naturally gravitate to – and below – their initial bids.

- Minimum Bid Decrement: The amount that a bid must be lowered in order to be acceptable. This should always be set because you don’t want, for example, vendors lowering their prices by a dollar per bid when the size of the bid is in thousands or millions of dollars.

- Overtime Rules (if applicable): The specifics of Overtime (including whether there is Overtime at all!) will vary depending on the auction type. But as an example, a common Overtime practice for Open Auctions is to set how much time must elapse with no bids for the auction to end (we call this parameter “Quiet Time”); for the auction to end, both (a) the End Time must have passed, and (b) more than the specified Quiet Time must have elapsed since the last bid.

Once your auction is configured, you can invite the vendors. In general, you’ll want to provide them some advance notice. We recommend that you allot at least one week between the invitation and the reverse auction itself.

PRO TIP: Run a mock reverse auction in advance of your live reverse auction to give vendors a chance to familiarize themselves with both the auction platform and the bidding process.Conduct the Reverse Auction

This is the exciting part. Most of the organizations with which we were reserve a conference room with a big-screen TV to watch the reverse auction. Some platforms will provide real-time updates. (We use a line graph where each vendor gets its own colored line and the X and Y axes show the time and price respectively.) If you’ve set everything up correctly and are using a good reverse auction platform, there shouldn’t be much for you to do except watch prices fall.

Contract with the Winner

Once the reverse auction is complete, you should have all the information you need to award a contract. It’s important to remember that the reverse auction is a negotiating tool and it contemplates price rather than value. Consequently, there is a strong, but imperfect correlation between the winner of the reverse auction and the vendor that ultimately is awarded the contract. And that correlation ties to the style of reverse auction that you use, which itself correlates with the type of product or service being bid. Certain types of auctions only make sense if you will definitely award a contract to the lowest bidder, and other types of auctions are more appropriate when that is not the case. As a rule, when dealing with highly-commoditized products, the lowest price will usually, but not always win.

The less commoditized the product or service, the more common it is for a vendor with a higher price to win the bid.

This makes sense if you evaluate the award process through the prism of value maximization. If your organization would strongly prefer to get its office supplies next week rather than next month, would you be willing to pay an additional 1%? Possibly. But if you did, you would be awarding to a vendor that didn’t win the reverse auction. As the product or service becomes more complex, so does the value calculation.

- Remember that the reverse auction is a high-speed negotiating tool, not a green light to award to the low bidder.

- Wrap things up by informing all the vendors who participated regardless whether or not you intend to award them the contract.

- Negotiate with the leading contenders, locking in a contract with your supplier of choice.

- Notify the non-winners and let them know that they were not selected.

- Remember that in today’s business environment, it’s increasingly difficult to distinguish between “vendors” and “partners.” Consequently, building a strong relationship with your vendor/partner is key to a successful engagement.

Additional Resource: 5 Things that Highlight the Value of Reverse Auction

Types of Reverse Auctions

Why are there different types of reverse auctions?

As discussed earlier, a reverse auction is a way to quickly and transparently negotiate price simultaneously, with two or more suppliers. While a buyer that sets up a reverse auction always wants to reduce cost, other considerations and constraints will vary. Put simply, there might be occasions when a buyer is simply seeking the lowest possible price and other occasions where there is a preferred supplier that just needs to come down below a certain threshold, but not offer the absolute lowest price.

Depending on the product or service being sourced and the associated goals of the buyer, one reverse auction format may make more sense than another. Two of the most common reverse auction types are the Open – or English – Reverse Auction and the Ranked Reverse Auction. In the paragraphs to follow, we will explore these formats in detail as well as learn about some other less-common reverse auction styles.

Reverse Open (English) Auction

If you’re like most people, your most common reference points of auctions of any type are from TV shows and movies. And if that’s the case, you will surely be familiar with the English Auction, which is also known as an Open Outcry Auction. Whether forward or reverse, English auctions share a characteristic: each adjustment to the price makes things less favorable to the bidder. Put that in your back pocket for now as we’ll revisit this before we close out this section. To simplify things, let’s start with what Hollywood has popularized and focus on the setup and rules for a Forward English Auction.

- The auctioneer establishes a reserve price for the item on sale. In this case, the reserve price represents the lowest price at which the seller will part with the item(s). The reserve price is kept secret, at least until it has been met and sometimes forever (other than to announce if the reserve has not been met at the conclusion of bidding).

- Bids are placed in a public forum, i.e., all bidders are aware of what the leading bid is and who placed it. The leading bid is often referred to as the “standing bid.”

- The auctioneer accepts subsequent higher bids from participants, provided they exceed some minimum increment, which is determined by the auctioneer, and improve upon the leading bid.

- The auction continues with bidders increasing the value of the high bid with each iteration until there are no bidders willing to exceed the standing bid by the aforementioned increment.

- The auction closes when no one challenges the standing bid. At this point, the bidder who made the standing bid is declared the winner of the auction.

Having read this, you may wonder, “What if no one bids at all?” In that case, the auctioneer has two options: either cancel the auction or reduce the starting price to a number where someone is willing to bid. But provided you have an item for sale at a price that is compelling to interested bidders, a forward English Auction is not only well defined, but easy to understand, which is one of the reasons that it’s a popular choice.

When to use a Reverse Open Auction

This style of reverse auction makes the most sense when the buyer wants to optimize specifically for price and is completely indifferent regarding which participating vendor is awarded the contract at the end. Put a different way, the reverse open auction maximizes the chances that you discover the lowest market price for whatever it is that you’re buying. If the goal is to reduce price, but there is a possibility that you’ll want to transact with a supplier that has not won the reverse auction, then you should not use this format.

Reverse Ranked Auction

While the most well-known auction style is English, the most commonly-used reverse auction format is the ranked auction. The recent rise of strategic sourcing has changed the approach of many organizations when it comes to how they interact with their suppliers. Even commodity spend can be considered strategic and while a pure “race-to-the-bottom” methodology might be an effective tactic, it can – in some cases – undermine longer-term strategic goals. To be clear, English-style reverse auctions are still valuable and useful, but the buyer should exercise discretion when selecting any auction format.

By using a reverse ranked auction, buyers allow themselves to make a multifactorial, rather than strictly cost-based, decision. In fact, it’s quite possible that the vendor with the worst, i.e., highest, bid can be awarded a contract and that may well be the optimal outcome. But before we spend too much time dissecting strategy, let’s walk through the process of running a ranked reverse auction.

- The auctioneer (optionally) establishes a reserve price for the item on sale. In a reverse auction, the reserve price represents the highest price at which the buyer is willing to consider purchasing the item(s).

- Bids are placed silently and then ranked by the auctioneer. The suppliers can see their own ranks, but have no information about

- how many suppliers are competing in the auction.

- the size of the gap that separates their bid from any other bids.

- The auctioneer accepts subsequent lower bids from participants, provided that the gap between the previous standing bid and the new one exceeds some minimum decrement, which is determined by the auctioneer, and is lower than the standing bid.

- The reverse auction continues with bidders lowering their bids and jockeying for rank until time (and overtime, if applicable) expires.

- Unlike with an English-style reverse auction, when the ranked reverse auction finishes, it’s not clear which vendor will be awarded the contract. The buyer may well choose to move forward with a vendor that didn’t deliver the lowest price.

When to use a Reverse Ranked Auction

Before considering when to use a reverse ranked auction, it’s important to know when not to use it: when searching for the absolute lowest price irrespective of any other criteria. However, if there are considerations beyond price and you would benefit from broad price discovery, a reverse ranked auction merits strong consideration.

A key strength of this auction format is that all the vendors have an opportunity to improve their bids, which won’t necessarily be the case in an English reverse auction. Imagine a scenario where a buyer is running a reverse auction for some product or service. One vendor, which has some considerable limitations, is desperate to win the business. In fact, this vendor is willing to do the deal at a loss simply for the opportunity to burnish its reputation and comes in with an initial bid of $1,000,000. All the other vendors have initial bids closer to $2,000,000. Several of them are willing to come down to $1,250,000. In a reverse English auction, this would not be considered a valid bid and no additional bidding would take place. (Remember, in an English-style auction, each bid must improve on the standing bid.) However, in a reverse ranked auction, all the other vendors could improve their bids.

Another consideration in choosing a reverse ranked auction has to do with the potential strategic nature of the relationship with the supplier. If the buyer currently works with a particular vendor or set of vendors and these are deemed key strategic relationships, then the decision to award a contract probably shouldn’t come down to whoever enters to the low bid. Not only are the optics bad, but the eliminating considerations beyond price is a recipe for disaster with strategic supplier relationships.

Reverse Dutch Auction

No, we’re not in for a repeat of Tulip Mania, though the Dutch auction traces its history back to the Dutch flower markets of the 17th century. Now they are more commonly used for issuing new financial securities, such as government bonds. The Dutch auction got a lot of press several years ago when Google used it to set the price for its IPO.

If you’ve been doing research on Dutch auctions, then you might have come away confused. There is a reason for that; there is conflicting information on how Dutch auctions actually work. This is because they can be run two different ways. Read on and we’ll explain….

A forward Dutch auction is also known as an open-outcry descending-bid auction. (Is there any wonder why nearly everyone just calls it Dutch?) Despite the fact that it’s open outcry, its mechanics are quite different than an English auction. First, let’s walk through a common forward implementation, which is sometimes called a Lowest Bidding Dutch Auction.

- The auctioneer establishes a starting price for the items to be purchased. A Dutch auction may have a single item up for bid, but it could also have a larger quantity of items. The starting price will almost invariably be higher than the price the auctioneer expects to receive. At this point, the auction opens and the starting price is shared with all the bidders.

- The bidders decide whether or not they want to participate at the price specified by the auctioneer and how many of the items they want to acquire. If there is insufficient bidding to buy out all the stock, the auctioneer will call out a lower price. Of course, if a single item is offered and there is a bid on it, the auction would end here.

- The bidders again decide whether they want to bid or for how much. If none do, the auctioneer will call out progressively lower prices until a bid is placed.

- When there have been bids for all the items, the items are then sold to the participating bidders at the lowest bid price, even if some of the bidders were willing to pay more. Ties are broken by tracking when the bid was placed, with the earliest bidders getting preference over those who submitted their bids later.

It’s easy to see how this gets confusing. In a forward Dutch auction, the price auction goes down, which is the opposite of most standard forward auctions. But these kinds of auctions occur in people’s day-to-day lives with some frequency. The most common example involves an overbooked flight. If you’ve ever been on one, you’ll hear an airline employee offer compensation to the person who is willing to switch to another flight. If there are no takers, the amount of compensation rises. This process continues until someone agrees to take the deal and change flights or until the airline feels that the cost is too high and ends the “auction.”

If we disembark from the aforementioned airplane and make our way to a financial institution, we’re likely to see an alternate implementation. We call this a “Single Submission Dutch Auction.”

- The auctioneer establishes a starting price and a quantity and may also determine a minimum price decrement. This information is shared with the bidders in addition to the basic information about the products or services and their quantities.

- All the bidders submit a single sealed bid, indicating their desired quantity and the price(s) they are willing to pay. To be clear, bidders can decide how much they want to buy and at what prices. For example, a bidder would ideally like to buy 100 units of a product, but only at a significant discount to the starting price. If the starting price is $1000, then bidder’s offer might look like this:

Units | Price |

|---|---|

5 | $950 |

10 | $900 |

20 | $800 |

30 | $700 |

35 | $550 |

This bidder could possibly purchase up to 100 units, but may well end up with fewer than that. There is no circumstance where this bidder would acquire more than 100 units in this auction.

3. Once the bids are collected, a clearing price is determined. This is the price where supply equals demand.

Now let’s see what happens in a reverse Dutch auction. First, we’ll look at the Lowest Bidding version:

- The auctioneer establishes a starting price for the products or services to be acquired. The starting price will almost invariably be lower than the price the buyer expects to pay. At this point, the auction opens and the starting price is shared with all the bidders.

- The bidders decide whether or not they want to participate at the price specified by the auctioneer. If none bid or not enough bid to fulfill the required number of products or services, the auctioneer will call out a higher price.

- The bidders again decide whether they want to bid and how much they want to bid on. If there is still insufficient supply to meet the specified volume of products or services, the auctioneer will call out progressively higher prices until enough bids have been placed.

- When there are enough bids to meet the requirements for products or services, the auction is complete. The bidders in the auction will be paid at the price established in the last round of the auction, which is the highest price.

And now we can explore the reverse Single Submission Reverse Auction. (For what it’s worth, since this is a “one-shot process,” it can be incorporated directly into an RFQ.

A Single Submission Reverse Dutch Auction has a lot of words but is actually very straightforward.

- The auctioneer establishes a starting price and a quantity and may also determine a minimum price increment. This information is shared with the bidders in addition to the basic information about the products or services and their quantities.

- All of the bidders submit a single sealed bid, indicating their desire to fill a specified quantity and the price(s) at which they are willing to do so.

- Once the bids are collected, the clearing price is determined and the bidding vendors are awarded accordingly.

In a single submission setup, timing should not be used to break a tie. Instead, the auctioneer will want to assign the award randomly. If the auction is down to two bidders, then a coin flip can serve this purpose. If there are more than two bidders who have tied, then the auction can assign numbers to eligible bidders and then generate a random number that corresponds to one of those numbers. The bidder whose number matches the random number would be the winner.

When to use a Reverse Dutch Auction

Although the price action is the opposite of a reverse English auction, a reverse Dutch auction satisfies many of the same requirements. It is a designed to help the buyer procure the product or service in question for the lowest possible price. The big difference is that the buyer is in control of the pricing. The vendors that are bidding can choose to opt in or out and specify the quantity if applicable. In some respects, speed of bid execution may be the determining factor. If the price hits a threshold where there is interest by more than one bidder, only the first one to make the bid will be win. Contrast that to a reverse English auction where other bidders have an opportunity to improve upon the leading bid.

Reverse Dutch auctions are very effective at identifying the market-clearing price for products and services. They are best suited to non-strategic commodity purchases. As a general rule, they should be used sparingly as overuse is likely to sour your supply base. Why? Reverse Dutch auctions apply “maximum psychological pressure” to participants, especially incumbent providers.

Reverse Japanese Auction

Our trip across the globe continues with the Japanese auction. Like a Dutch auction, the auctioneer controls the bidding cadence. And like an English auction, a forward Japanese auction involves the pricing moving higher. Here are the key steps in conducting this type of auction:

- The auctioneer establishes a starting price for the good that is to be sold. A price increment and time interval are set, e.g. $100 per minute. The auction opens and the starting price is shared with all the bidders.

- The bidders decide whether or not they want to participate at the price specified by the auctioneer. If they do, they opt in. Otherwise, they opt out and disqualify themselves from the auction.

- When the time interval elapses, the price goes up by the specified amount. Again, the bidders decide whether they want to opt in or not. If they do, they continue. And if they don’t, they remove themselves from the auction.

- This process repeats itself until there is just one remaining bidder. That bidder is deemed to have won the auction.

It’s pretty easy to imagine flipping this process around for a reverse Japanese auction. But to minimize any confusion, we’ll once again walk you through the steps.

- The auctioneer establishes a starting price for the product or service to be provided. A price decrement and time interval are set, e.g. $100 per minute. The auction opens and the starting price is shared with all the bidders.

- The bidders decide whether or not they want to participate at the price specified by the auctioneer. If they do, they opt in. Otherwise, they opt out and disqualify themselves from the auction.

- When the time interval elapses, the price is reduced by the specified amount. Again, the bidders decide whether they want to opt in or not. If they do, they continue. And if they don’t, they remove themselves from the auction.

- This process repeats itself until there is just one remaining bidder. That bidder is deemed to have won the auction.

When to use a Reverse Japanese Auction

If you like most of the dynamics of a reverse Dutch auction, but want to tamp down the pressure and get a bit more price discovery, then the reverse Japanese auction may be the way to go. As an opt-out rather than opt-in format, reverse Japanese auctions should provide at least as many award options at a particular price point. This feature is consistent with more commonly-used reverse auction styles.

Note that there are many similarities between Japanese and Dutch auctions. The primary difference is that the former is an opt-out while the latter is an opt-in. Consequently, the pressure is higher for Dutch auctions as timing is critical. In multi-item Dutch auctions, timing is used a tie-breaker. And in a single-item Dutch auction, the first party to bid will end the auction.

Other Auction Types

The above-discussed auction formats represent the vast majority of all auctions that are conducted, forward or reverse. There are additional auction styles, however. We’ll touch very briefly on two of them.

Vickery Auction

Named for 1996 Nobel Laureate, William Vickery, the auction involves a single round of bidding. The winner is the bidder that submitted the best price. However, the product or service is transacted at the second-best price.

Yankee Auction

For the most part, a Yankee auction functions like a Dutch auction. However, when the auction closes, all bids are ranked best to worst (and in the event of a tie, earliest to latest). Then the good or service is awarded by going down the list, making awards until the inventory is exhausted.

Additional Considerations

Once you’ve determined the style or type of reverse auction that makes sense for the product(s) or service(s) that you’re planning to buy, you will need to make some decisions on the remaining details.

Line Items and Lots

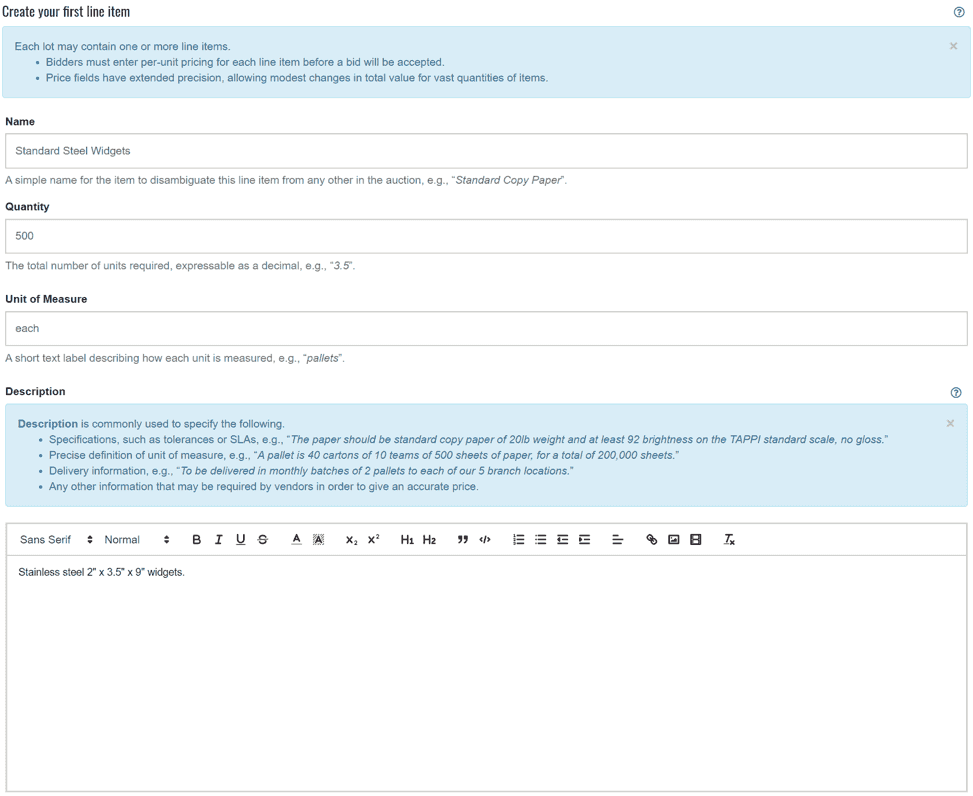

A reverse auction must consist of at least one line item and a single lot. A line item has several important characteristics. At a bare minimum, it should have the following.

- The name of the item that is being purchased.

- A quantity, i.e., the number of those items being purchased and the unit of measure. (You want to make that no one is confused about your ordering 1000 items vs. 1000 pallets of items.)

Depending on the reverse auction software you use, you might be able to provide additional descriptive information like a specification. As an example, here’s how a line item gets configured in Vendorful.

More detailed specifications may be given at the auction level rather than at the line-item level. For example, if you were to have contractors bid on building a store, then not only would you want to share blueprints, renderings, and the like well in advance of the auction, but you would want that information to be conveyed separately from the line item details.

A “lot” consists of one or more (usually) related line items and will have some configuration as well. But before we get into that, let’s understand how we think about lots.

Typically, the line items in a lot are related, but if there are a relatively small number of them and they can (and will) all be sourced from the same supplier, seemingly unrelated line items can coexist in a lot. For example, it’s possible that you could put standard office supplies and computer equipment out to bid in the same lot, provided you don’t have too many items to list. On the other hand, you could have multiple lots for items that many would consider very related. For example, a company ran a reverse auction on the Vendorful platform for refrigerators and freezers. These were, in fact, split into two lots:Lot 1: Refrigerators

Units | Price |

|---|---|

1-Door Refrigerator | 1830 |

2-Door Refrigerator | 1680 |

3-Door Refrigerator | 100 |

Lot 2: Freezers

Units | Price |

|---|---|

1-Door Freezer | 1700 |

2-Door Freezer | 1300 |

3-Door Freezer | 100 |

There are several reasons that you might split related items into multiple lots:

- A lot might have too many line items.

- The buyer might want to award by lot rather than have a single auction winner.

- The auction might be configured to reflect the buyer’s category management.

Once you’ve decided how many lots should be in the reverse auction and which line items should be in the lot, there are a few other variables to consider. These depend on the software platform you’re using as some will apply these rules strictly at the auction level while others will allow you to do so at the lot level. Vendorful currently provides the following options at the lot level:

- Reverse auction style/type, e.g. Reverse Open vs. Reverse Ranked.

- Currency.

- Maximum starting bid.

- Minimum bid decrement.

Scheduling

Just as the reverse auction will have start and end time — the latter’s being subject to overtime — each lot will similarly have a start and end time. They are themselves also subject to overtime in addition to being constrained by the auction’s start and end times. Put simply, the lot can’t begin before the auction has or end after the auction has.

Depending on what’s being put out for bid and the number of lots, the buyer can choose to have lots run contemporaneously or sequentially. And particularly thoughtful buyers will often schedule a short five to ten-minute break between sequential lots.

Bear in mind that if the last lot of an auction goes into overtime, the software you use should extend the auction itself until the final lots is completed.

Practice

Many vendors will not be familiar with reverse auctions. In fact, it’s possible that some have never heard of the concept. (Please feel free to send them this guide!) Inasmuch as their reading up on the subject is helpful, actual participation in a live mock reverse auction is extremely helpful.

Ideally, you’ll configure the auction to roughly match the live one. This is true of the auction style as well as more specific things, e.g. a multi-lot reverse auction should have a multi-lot practice round. You’ll want to make sure that mock reverse auction does not have line items from the actual purchase that you’re planning on doing. We’ve seen buyers remove any potential confusion by naming line items “Widgets,” “Gizmos,” and “Do-Dads.”

In advance of the mock reverse auction, it’s a good idea to ask that the vendors not immediately race to the bottom in terms of price. If that happens, there could be an auction winner before most of the competitors have had a chance to place a bid.

Implementing Reverse Auction Software

Organizations that leverage reverse auction see significant savings while simultaneously reducing the amount of time spent negotiating. Learning about some key ways that reverse auctions drive business value in advance of evaluating solutions is a good investment of your time before choosing a reverse auction solution provider.

Reverse auctions are not appropriate for all — or even most — sourcing activities. However, when the fit is right, they can be transformational for procurement departments. The best solutions are low risk, paying for themselves and delivering positive ROI from the very first event. The list below highlights some key features to look for when evaluating reverse auction software.

Interested in learning more about how to incorporate reverse auctions with e-Sourcing software?

Put a Demo on the Calendar

We'll show you how you can use Vendorful to drive big savings in record time.